Research

Firms’ response to slacktivism: when and why are e-petitions effective?

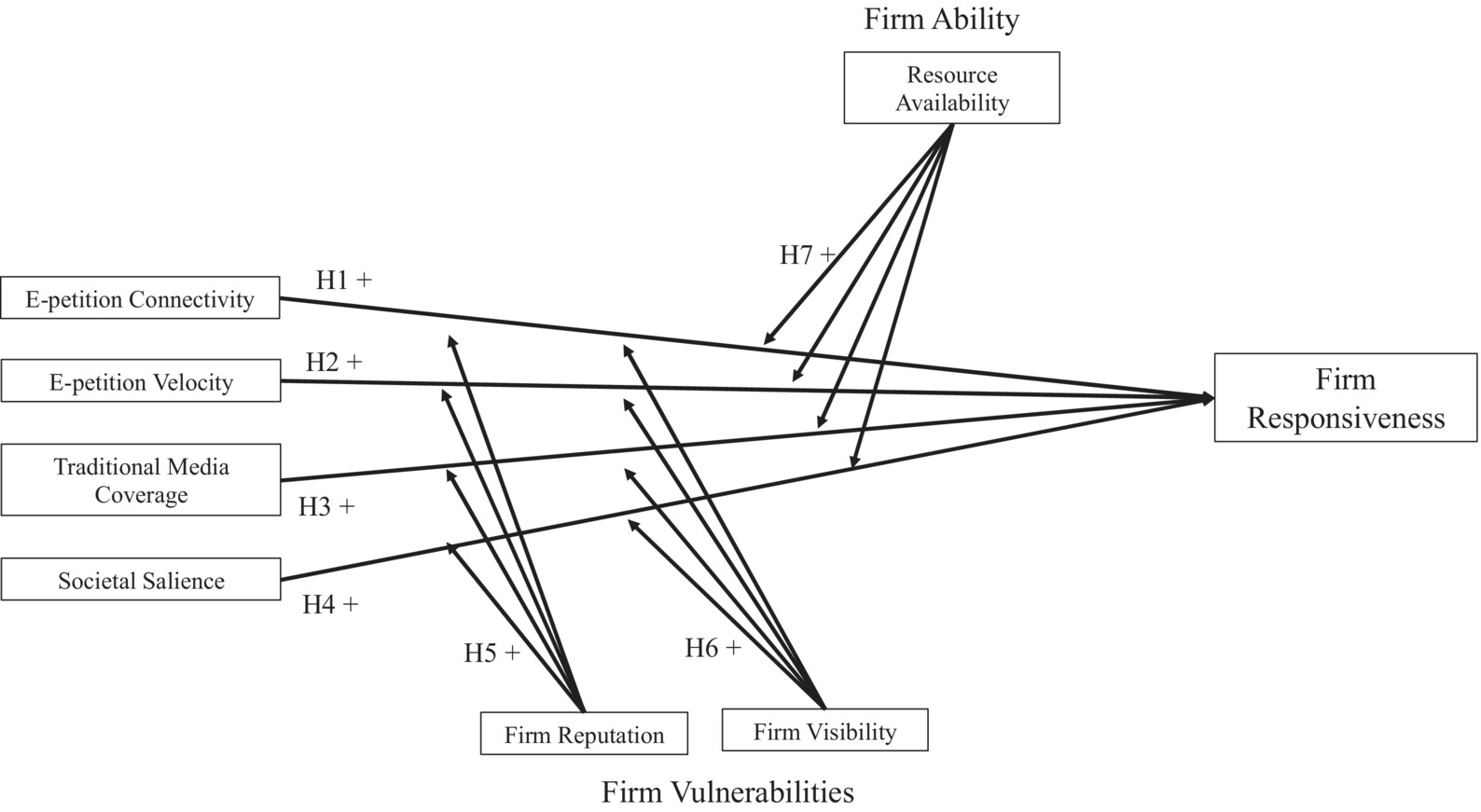

E-petitions are online requests for change that can target various organizations, including firms. But do e-petitions matter? Some scholars argue that e-petitions are ineffective in achieving their goals as they mainly attract slacktivists who offer token support without taking any real action. Nonetheless, we challenge this notion and suggest that e-petitions have the potential to be a powerful tool for creating social change because they can damage the image and reputation of the targeted firm. E-petitions operate on the logic of connective action, which uses technology to connect individuals who share common grievances and goals without formal structures or leaders. Our review of 1587 e-petitions filed against Fortune 500 firms between 2010 and 2018 found that e-petitions can effectively change firm behavior, especially when they have high connectivity, velocity, and traditional media coverage. Therefore, e-petition supporters should focus on mobilizing as many people as possible to sign and share the e-petition on social media platforms and seek attention from newspapers, television, or radio.

E-petitions are online requests for change that can target various organizations, including firms. But do e-petitions matter? Some scholars argue that e-petitions are ineffective in achieving their goals as they mainly attract slacktivists who offer token support without taking any real action. Nonetheless, we challenge this notion and suggest that e-petitions have the potential to be a powerful tool for creating social change because they can damage the image and reputation of the targeted firm. E-petitions operate on the logic of connective action, which uses technology to connect individuals who share common grievances and goals without formal structures or leaders. Our review of 1587 e-petitions filed against Fortune 500 firms between 2010 and 2018 found that e-petitions can effectively change firm behavior, especially when they have high connectivity, velocity, and traditional media coverage. Therefore, e-petition supporters should focus on mobilizing as many people as possible to sign and share the e-petition on social media platforms and seek attention from newspapers, television, or radio.

Read the article here.

When does CEO compensation plan based on risk change firm strategic variation and strategic deviation? The moderating role of shareholder return

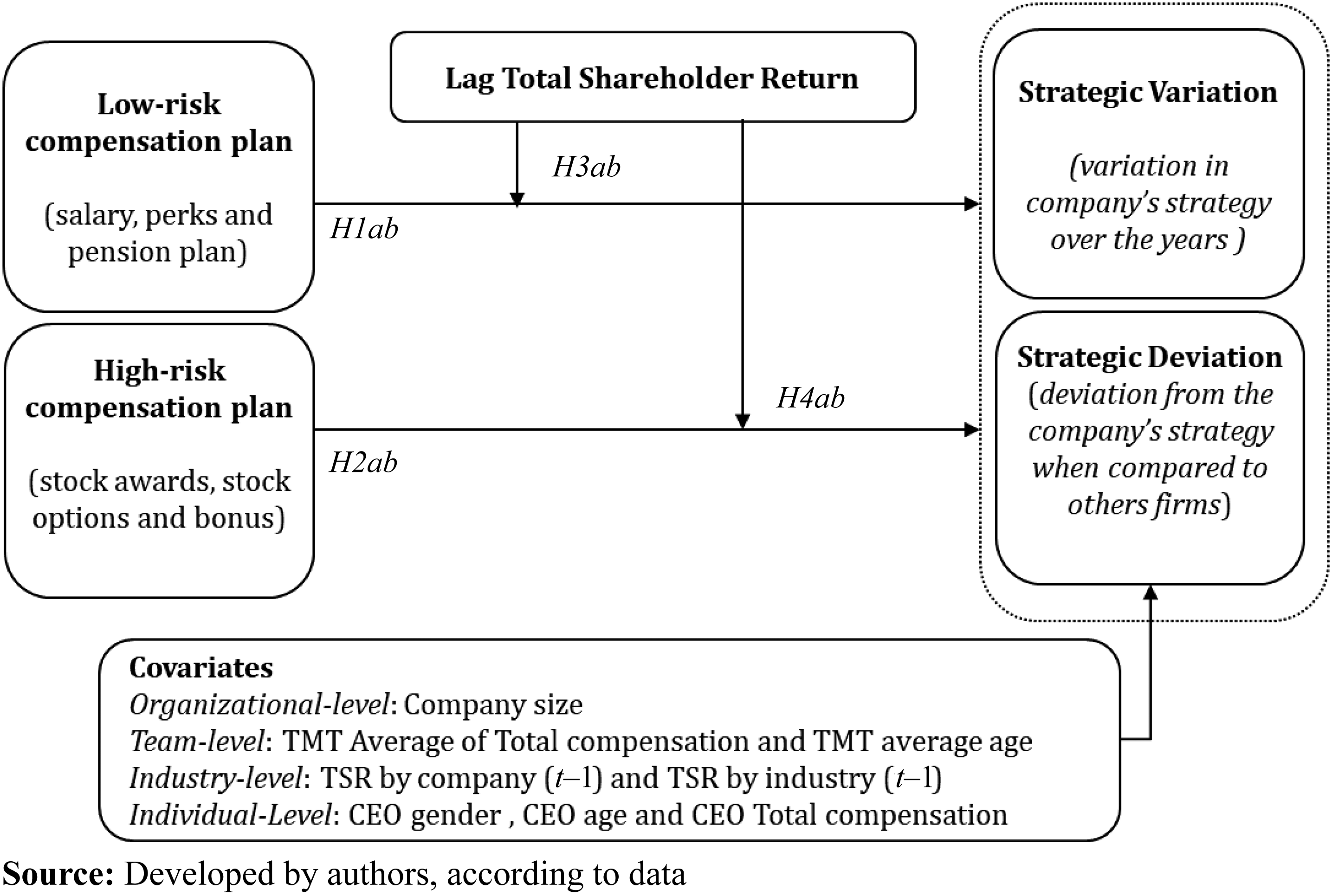

The analysis of executive compensation plans has been a long-standing topic of interest among scholars and professionals, especially in comprehending their impact on a firm’s strategic decisions. While there is agreement on aligning CEO incentives with shareholder interests, significant gaps in understanding persist. This study addresses these gaps by classifying compensation plans into low- and high-risk components and their implications for strategic variation and deviation within firms. Low-risk compensation generally encourages a conservative approach, with CEOs maintaining current strategies because they are satisfied with the status quo. On the other hand, high-risk compensation stimulates a proactive stance, urging CEOs to explore innovative strategies and pursue long-term value, which has a positive effect on strategic variation and deviation. Our findings suggest a change in approach towards compensation plans that emphasize risk components, thereby mitigating agency costs and aligning CEO interests with shareholder objectives. By prioritizing risk-focused compensation structures over traditional short- and long-term incentives, firms can promote strategic adaptability, driving innovation and sustainable growth. This nuanced approach provides a practical framework that guides practitioners toward more informed and effective executive compensation strategies.

The analysis of executive compensation plans has been a long-standing topic of interest among scholars and professionals, especially in comprehending their impact on a firm’s strategic decisions. While there is agreement on aligning CEO incentives with shareholder interests, significant gaps in understanding persist. This study addresses these gaps by classifying compensation plans into low- and high-risk components and their implications for strategic variation and deviation within firms. Low-risk compensation generally encourages a conservative approach, with CEOs maintaining current strategies because they are satisfied with the status quo. On the other hand, high-risk compensation stimulates a proactive stance, urging CEOs to explore innovative strategies and pursue long-term value, which has a positive effect on strategic variation and deviation. Our findings suggest a change in approach towards compensation plans that emphasize risk components, thereby mitigating agency costs and aligning CEO interests with shareholder objectives. By prioritizing risk-focused compensation structures over traditional short- and long-term incentives, firms can promote strategic adaptability, driving innovation and sustainable growth. This nuanced approach provides a practical framework that guides practitioners toward more informed and effective executive compensation strategies.

Read the article here.

How do firms that are changing the world engage politically?

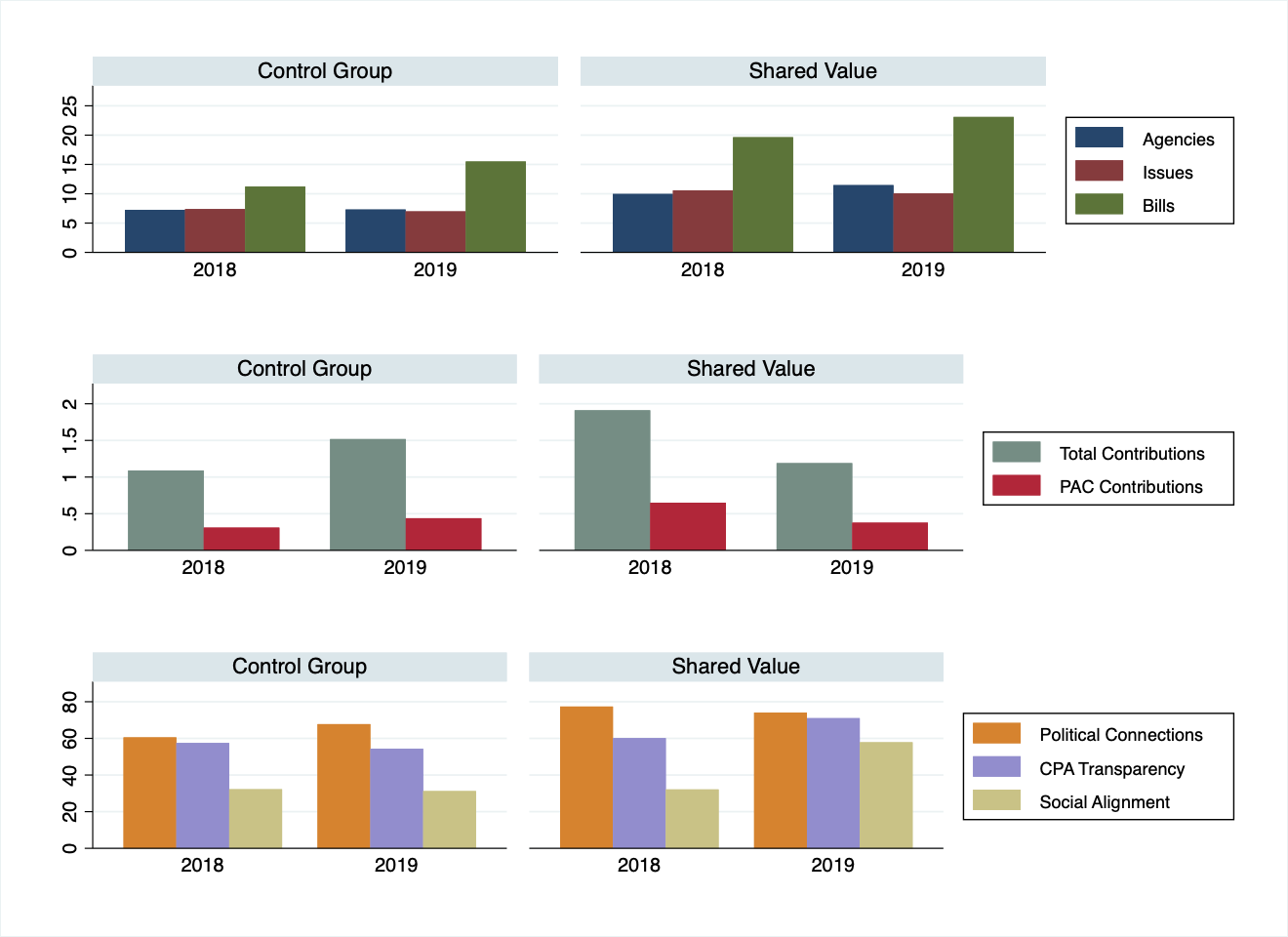

Many firms are being encouraged to focus on policies and practices that improve their competitiveness while also promoting economic and social conditions in the communities they operate in. These types of firms are called shared value firms. In this article, we investigate how shared value firms use their political efforts, whether they aim to align these efforts with their social goals, and how this alignment impacts their financial performance. We conducted a study using a matched-sample design, comparing public firms in the Change the World list in 2018 and 2019. Our results show that shared value firms have more political breadth and connection, and make more PAC contributions than firms in the control group. However, we found that shared value firms are not more likely to align their social and political efforts. Additionally, we discovered that firms with aligned social and political efforts do not necessarily perform better financially. These findings are significant for the literature on firm social and political efforts.

Many firms are being encouraged to focus on policies and practices that improve their competitiveness while also promoting economic and social conditions in the communities they operate in. These types of firms are called shared value firms. In this article, we investigate how shared value firms use their political efforts, whether they aim to align these efforts with their social goals, and how this alignment impacts their financial performance. We conducted a study using a matched-sample design, comparing public firms in the Change the World list in 2018 and 2019. Our results show that shared value firms have more political breadth and connection, and make more PAC contributions than firms in the control group. However, we found that shared value firms are not more likely to align their social and political efforts. Additionally, we discovered that firms with aligned social and political efforts do not necessarily perform better financially. These findings are significant for the literature on firm social and political efforts.

Read the article here.

Assessing the methodological differences between brazilian journals and top Journals in strategy

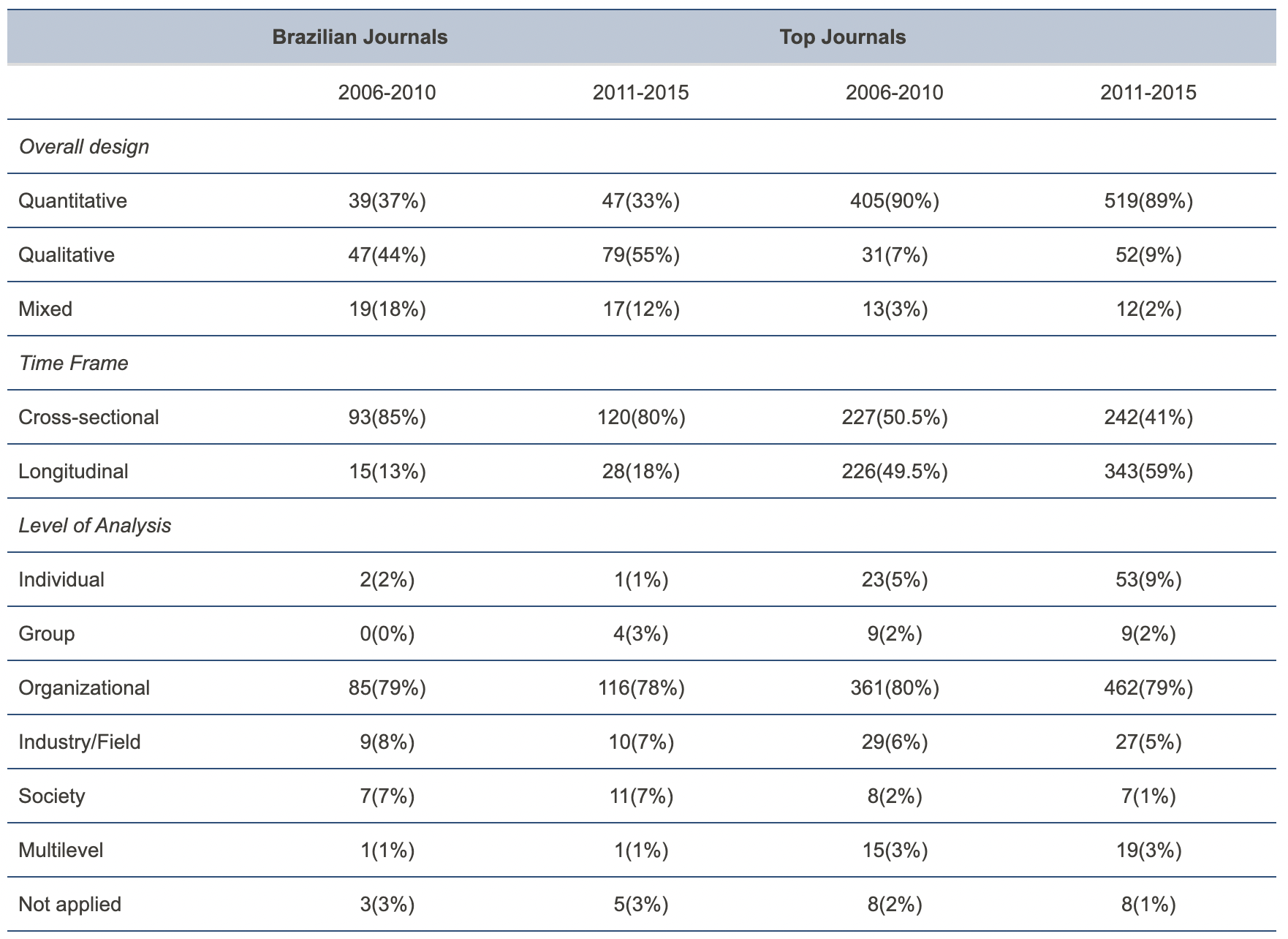

The discussion about the quality of academic publication in Brazil has been a constant in the last decades. In this article, we evaluate the methodological differences between papers published in Brazilian journals and papers published in AMJ, OS, ASQ, JMS and SMJ in field of strategy from 2006 to 2015. Based on a systematic review of 1294 empirical papers, we identify and describe methodological differences, offering a benchmark to improve future studies. Specifically, we find that Brazilian papers can be carachterized as testers, reinforcing results found by other studies about the necessity of developing the Brazilian strategy field to be more competitive with the international field at large. We discuss the reasons those differences exist and their implications towards advancing the field of strategy. Then, we suggest forms of overcoming the current constraints and improving the quality of our research to help to consider the Brazilian reality.

The discussion about the quality of academic publication in Brazil has been a constant in the last decades. In this article, we evaluate the methodological differences between papers published in Brazilian journals and papers published in AMJ, OS, ASQ, JMS and SMJ in field of strategy from 2006 to 2015. Based on a systematic review of 1294 empirical papers, we identify and describe methodological differences, offering a benchmark to improve future studies. Specifically, we find that Brazilian papers can be carachterized as testers, reinforcing results found by other studies about the necessity of developing the Brazilian strategy field to be more competitive with the international field at large. We discuss the reasons those differences exist and their implications towards advancing the field of strategy. Then, we suggest forms of overcoming the current constraints and improving the quality of our research to help to consider the Brazilian reality.

Read the article here.